Net Present Value Formula

The net present value formula calculates NPV, which is the difference between the present value of cash inflows and the present value of cash outflows, over a period of time. Net present value (NPV) determines the total current value of all cash flows generated, including the initial capital investment, by a project. Let us study the net present value formula using solved examples.

What is Net Present Value Formula

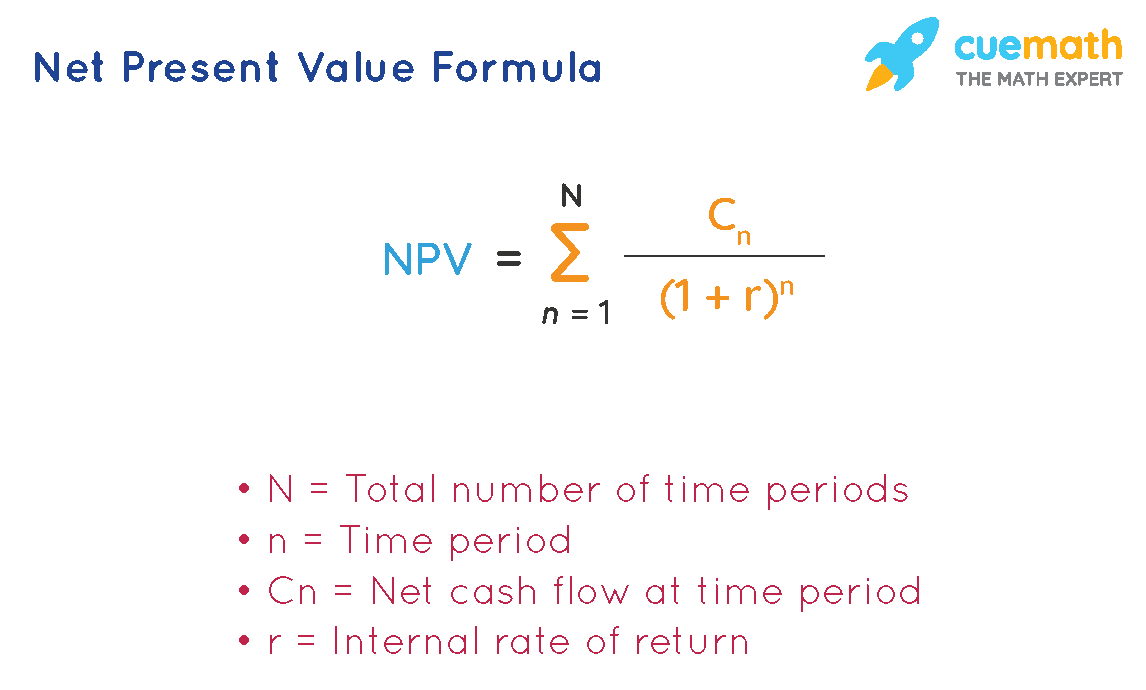

The net present value formula finds application in estimating which projects are likely to generate great profits. Thus the formula can be expressed as:

\( NPV = \sum_{n = 1}^N \frac{ C_n }{ (1 + r)^n } \)

- N = Total number of time periods

- n = Time period

- \(C_n\) = Net cash flow at time period

- r = Internal rate of return

OR

NPV can also be calculated by finding the difference between the Present Value(PV) after the competition of time duration of investment and the initial amount invested where the Present Value "PV" after time "t" for a rate of return "r" can be calculated as:

Present value, PV = \(\frac{ \text {cash value at time period }}{ (1 + \text {rate of return})^{ \text {time period}}}\)

Net Present Value Formula Rules

There are certain signs that are used in the net present value formula that determine whether the investment is good or bad. They are as follows:

- NPV > 0 = The present value of money coming in is more than the money going out. The investment is good since the money earned from the investment is more than the money invested

- NPV = 0 = When the money earned from the investment is equal to the money invested

- NPV < 0 = The money earned from the investment is less than the money invested

Examples on Net Present Value Formula

Example 1: An investor made an investment of $500 in property and gets back $570 the next year. If the rate of return is 10%. Calculate the net present value.

Solution:

Given:

Amount invested = $500

Money received after a year = $570

Rate of return = 10% = 0.1

Using net present value formula,

Present value, PV = \(\frac{ \text {cash value at time period }}{ (1 + \text {rate of return})^{ \text {time period}}}\)

PV = \(\frac{ \$ 570}{ (1 + 0.1 )^1}\)

PV = $570/1.1

PV = $518.18

Net Present Value = $518.18 − $500.00 = $18.18

Therefore, for 10% rate of return, investment has NPV = $18.18.

Example 2: Sam bought a house for $750,000 and sells it a year later for $990,000, after deducting any realtor's fees and taxes. Calculate net present value, if the rate of return is 5%.

Solution:

Given:

Investment on buying the house = $750,000

Monet received from sale a year later = $990,000

Rate of return = 5% = 0.05

Using net present value formula,

Present value, PV = \(\frac{ \text {cash value at time period }}{ (1 + \text {rate of return})^{ \text {time period}}}\)

PV = \(\frac{ \$ 990,000}{ (1 + 0.05 )^1}\)

PV = $990,000/1.05

PV = $942,857.143

Net Present Value = $942,857.143 − $750,000 = $192,857.143

Therefore, for 5% rate of return, investment has NPV = $192,857.143

Example 3: If the rate of return is 5%, what would be the net present value of a box of fruits with the price at $20,000 and a year later it costs $45,000.

Solution: Given,

Current price of box = $20,000

Year later = $45,000

Rate of return = 5% = 0.05

Using the net present value formula,

Present value, PV = \(\frac{ \text {cash value at time period }}{ (1 + \text {rate of return})^{ \text {time period}}}\)

PV = 45000/(1 + 0.05)1

PV = 42857.15( please check)

Net present value = 42857.15 - 20,000 = 22857.15

Therefore, the net present value is $22857.15

FAQs on Net Present Value Formula

What is Net Present Value Formula?

The net present value formula calculates NPV, which is the difference between the present value of cash inflows and the present value of cash outflows, over a period of time. The net present value formula finds application in estimating which projects are likely to generate great profits.

What is the Formula to Calculate the Net Present Value Formula?

The formula to calculate the net present value is:

\( NPV = \sum_{n = 1}^N \frac{ C_n }{ (1 + r)^n } \)

- N = Total number of time periods

- n = Time period

- \(C_n\) = Net cash flow at time period

- r = Internal rate of return

What is the Formula to Find the Present Value?

NPV can also be calculated by finding the difference between the Present Value(PV) after the competition of time duration of investment and the initial amount invested where the Present Value "PV" after time "t" for a rate of return "r" can be calculated as:

Present value, PV = \(\frac{ \text {cash value at time period }}{ (1 + \text {rate of return})^{ \text {time period}}}\)

What are the Three Important Rules of Net Present Value Formula?

The three important rules to keep in mind while calculating the net present value is:

- NPV > 0 = The present value of money coming in is more than the money going out. The investment is good since the money earned from the investment is more than the money invested

- NPV = 0 = When the money earned from the investment is equal to the money invested

- NPV < 0 = The money earned from the investment is less than the money invested

visual curriculum