Net Profit Ratio

The net profit ratio is the ratio of the profit after taxes to the net sales of a company. In simple words, we can say that it is the ratio of the net profit to the net revenue of the business. It is generally expressed as a percentage or a rational number so as to compare the profits with the sales of the company and determine how much profit has been made in a specific segment. The net profit ratio is one of the most important indicators of a firm's financial health.

In this article, we will explore the concept of net profit ratio, its formula, and its meaning. We will also discuss the difference between the net profit and gross profit ratio and solve a few examples related to them for a better understanding of the concept.

What is Net Profit Ratio?

Net profit ratio is the ratio indicating the company's or firm's profit in a business segment. It is calculated by dividing the company's profit by the net sales. We can express the net profit ratio in percentage or rational or decimal form. This helps in evaluating a company's financial health. The net profit ratio tells the net profit a company makes from the total revenue. Let us understand its meaning in the next section.

Net Profit Ratio Meaning

Net profit ratio is defined as the amount of each dollar of revenue/sales that a company has left over as profit after it pays all of its expenses and taxes. If the value of this ratio is negative, then it indicates the net loss ratio. It can be calculated by dividing the net profit by net sales over a given period of time and can be expressed in percentage by multiplying the ratio by 100.

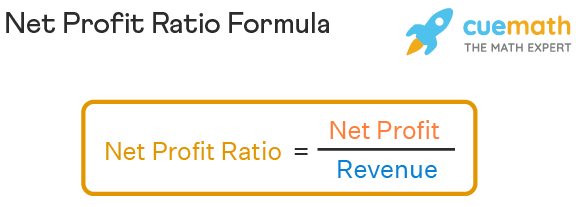

Net Profit Ratio Formula

We can calculate the net profit ratio of a company by subtracting all expenses and taxes from the revenue and subtracting it by the revenue. The formula for the net profit ratio can be expressed as,

Net Profit Ratio = [ (R - C - E - I - T) / R ] × 100 --- (Expressed as percentage), where

- R = Revenue

- C = Cost of all goods sold

- E = Operating and other expenses

- I = Interest

- T = Taxes

We can also express this formula as

Net Profit Ratio = Net Profit / Revenue --- (Expressed in rational form)

Net Profit Margin Ratio

The net profit margin ratio is nothing but another name for the net profit ratio. It is expressed as a percentage and measures how much net profit has been generated as a percentage of the revenue. Generally, a net profit margin of 5% is considered low, a 10% net profit ratio is considered average and a net profit margin of 20% is considered good or high. A negative profit margin indicates that the production costs are higher than the total revenue over a period of time and hence indicates a loss.

Difference Between Net Profit Ratio and Gross Profit Ratio

Let us understand the difference between the net profit and gross profit ratio in the table given below:

| Net Profit Ratio | Gross Profit Ratio |

|---|---|

| The net profit ratio is the ratio of the income after deducting the cost of produced goods, taxes, interest, and other expenses from the revenue to revenue. | The gross profit ratio is the ratio of income left after deducting the cost of producing goods from the revenue to the revenue. |

| It takes into account the taxes, interest, and other expenses before determining the net profit ratio. | It does not take into account the taxes, interest, and other expenses before determining the gross profit ratio. |

| It is a better indicator of the company's financial health. | It is not an accurate indicator of a company's financial health. |

Important Notes on Net Profit Ratio

- Net profit ratio is defined as the amount of each dollar of revenue/sales that a company has left over as profit after it pays all of its expenses and taxes.

- It is one of the important indicators of a company's financial health.

- It takes into account all costs, interest, taxes, and other operating expenses.

☛ Related Articles:

Net Profit Ratio Examples

-

Example 1: Find the net profit ratio in the percentage of a company over a period of time if the revenue is $6500, variable costs are $1600 and fixed costs are $400.

Solution: To calculate the net profit ratio, we first subtract all the costs from the revenue.

Total costs = Variable costs + Fixed costs = $1600 + $400 = $2000

Net Profit Ratio = ( Revenue - Total costs ) / Revenue × 100

= ($6500 - $2000) / $6500 × 100

= $4500 / $6500 × 100

= 0.69 × 100

= 69%

Answer: The net profit ratio in percentage is 69%.

-

Example 2: Find the gross profit ratio if the revenue is $1000 and the cost of produced goods is $220.

Solution: To find the gross profit ratio, we subtract the cost of produced goods from the revenue.

Gross profit ratio = (Revenue - Cost) / Revenue

= (1000 - 220) / 1000

= 780 / 1000

= 0.78

= 78%

Answer: The gross profit ratio is 0.78.

-

Example 3: Calculate the net profit ratio when the following are given:

- Revenue = $14,500

- Cost of Revenue = $8100

- Other operating expenses = $3000

- Interest = $80

- Tax = $800

Solution: To find the net profit ratio, we will use the formula,

Net Profit Ratio = [ (R - C - E - I - T) / R ] × 100 --- (Expressed as percentage), where

- R = Revenue

- C = Cost of all goods sold

- E = Operating and other expenses

- I = Interest

- T = Taxes

We have

Net Profit Ratio = [ (14500 - 8100 - 3000 - 80 - 800) / 14500 ] × 100

= (2520/14500) × 100

= 0.1738 × 100

= 17.38%

Answer: The net profit ratio is 17.38%.

FAQs on Net Profit Ratio

What is the Net Profit Ratio?

Net profit ratio is defined as the amount of each dollar of revenue/sales that a company has left over as profit after it pays all of its expenses and taxes.

What is a Good Net Profit Ratio?

Generally, a net profit ratio between 10% and 20% is considered to be good. A net profit ratio of 10% is considered to be average and a net profit ratio of 20% is considered to be high.

What is the Formula of Net Profit Ratio?

The formula for the net profit ratio can be expressed as,

Net Profit Ratio = [ (R - C - E - I - T) / R ] × 100 --- (Expressed as percentage), where

- R = Revenue

- C = Cost of all goods sold

- E = Operating and other expenses

- I = Interest

- T = Taxes

How to Interpret Net Profit Ratio?

The net profit ratio compares a company's profits to its total revenue. This helps in evaluating a company's financial health.

Why Do We Calculate Net Profit Ratio?

We calculate the net profit ratio of a company to determine its financial value of a company. It helps to determine the current practices followed by the company are efficient or not.

Is a High Net Profit Ratio Good?

A high net profit ratio of a company indicates that a company is good at converting sales into profits and is exercising good cost control.

How Do You Calculate Net Profit Ratio?

We can calculate the net profit ratio is the ratio of the income after deducting the cost of produced goods, taxes, interest, and other expenses from the revenue to revenue.

visual curriculum