Internal Rate of Return Formula

The internal rate of return (IRR), also referred to as the discounted cash flow of return (DCFROR), is the interest rate that makes the net present value zero. The internal rate of return formula calculates IRR, which is a very important component of capital budgeting and corporate finance which is used in determining which discount rate will make the initial cost of a capital investment equal to the current value of future cash flows post-tax. The term internal here signifies the fact that the calculation of rate using this method does not include external factors, such as inflation, risk-free rate, the cost of capital, or any financial risks. Let us study the internal rate of return formula using solved examples.

What is Internal Rate of Return Formula?

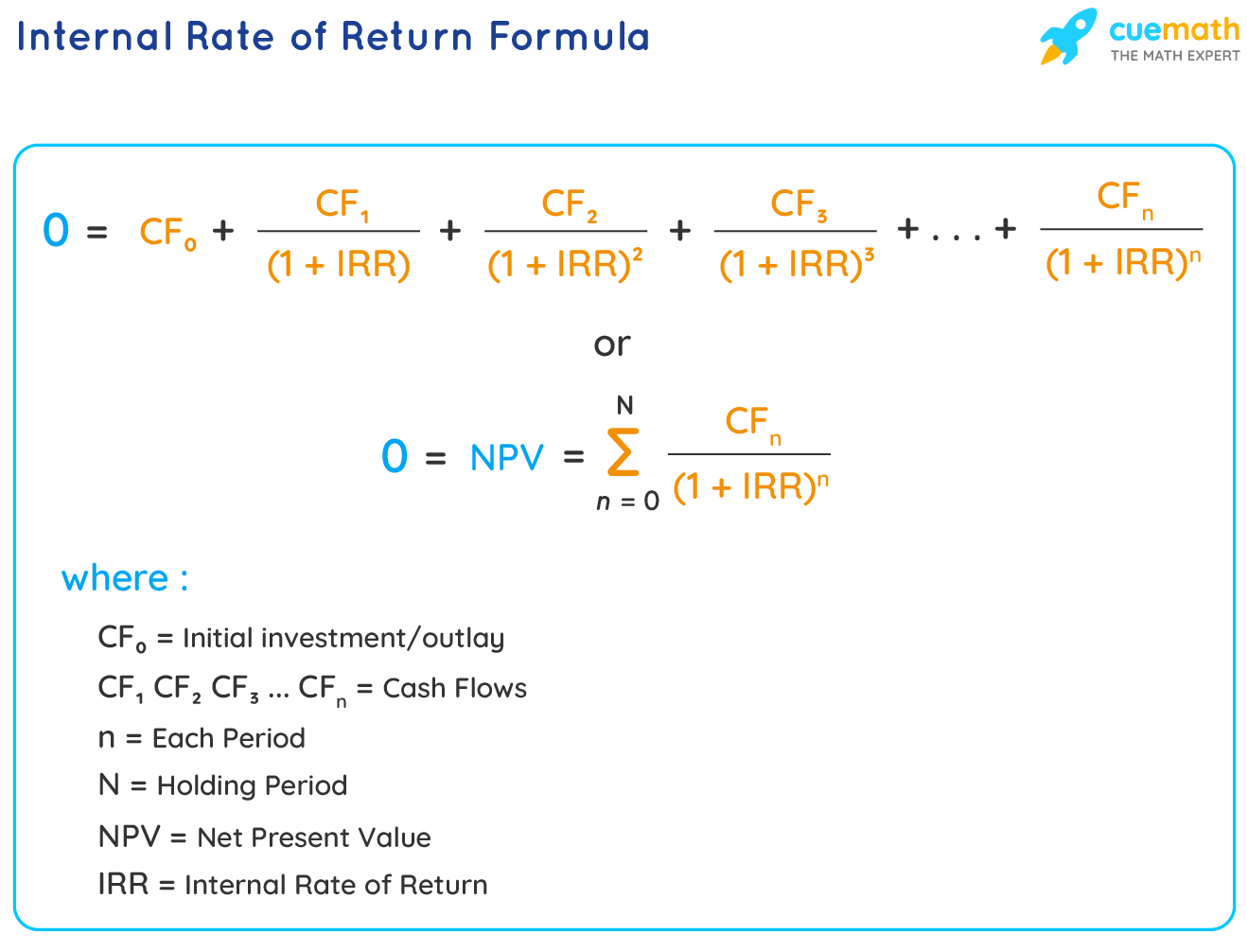

The calculation of the Internal Rate of Return (IRR) includes the trial and error method with the formula of calculation of Net present value (NPV). The internal rate of return formula calculates IRR, which is the value of the rate for which net present value equals zero. The internal rate of return formula can be expressed as,

\( 0 = \sum_{n = 1}^N \frac{ CF_n }{ (1 + IRR)^n } \)

Internal Rate of Return Formula

The internal rate of return formula can be written as,

\( 0 = \sum_{n = 1}^N \frac{ CF_n }{ (1 + IRR)^n } \)

Where,

- N = Total number of time periods

- n = Time period

- CF\(_n\) = Net cash flow at time period

- IRR = Internal rate of return

Rules to Calculate Internal Rate of Return Formula

There are certain rules to keep in mind while calculating the internal rate of return formula. They are:

- Set the NPV to zero and solve for the discount rate i.e. the internal rate of return

- The initial investment is always negative because it represents an outflow

- Each subsequent cash flow could be positive or negative, depending on the estimated cash flow determined by the project in the future

- IRR cannot be easily calculated analytically instead use a more technical method like excel

Examples Using Internal Rate of Return Formula

Example 1: An investor made an investment of $500 and got $570 next year. Calculate the internal rate of return on the investment.

Solution:

Given:

Invested amount, CF\(_0\) = -$500 (negative, because money went out)

Cash inflow after 1 year, CF\(_1\) = $570

Using internal rate of return formula,

0 = CF\(_0\) + \(\dfrac{CF_1}{{(1 + IRR)}^1}\)

0 = -$500 + \(\dfrac{570}{{(1 + IRR)}^1}\)

500 + 500 × IRR = 570

IRR = 70/500

IRR = 0.14 = 14%

Therefore, the internal rate of return on the investment = 14%.

Example 2: Sam bought a house for $250,000. He plans on selling the house 1 year later for $350,000, after deducting any realtor's fees and taxes. Calculate the internal rate of return on the complete transaction.

Solution:

Given:

Invested amount, CFo = -$250,000 (negative, because money went out)

Cash inflow after 1 year, CF\(_1\) = $350,000

Using internal rate of return formula,

0 = CF\(_0\) + \(\dfrac{CF_1}{{(1 + IRR)}^1}\)

0 = -$250,000 + \(\dfrac{350,000}{{(1 + IRR)}^1}\)

250,000 + 250,000 × IRR = 350,000

IRR = 100,000/250,000

IRR = 0.4 = 40%

Therefore, the internal rate of return on the investment = 40%.

Example 3: Josie made an investment of $700 and got $800 the next year. Calculate the internal rate of return on the investment.

Solution:

Given:

Invested amount, CF\(_0\) = -$700 (negative, because money went out)

Cash inflow after 1 year, CF\(_1\) = $800

Using internal rate of return formula,

0 = CF\(_0\)+ \(\dfrac{CF_1}{{(1 + IRR)}^1}\)

0 = -700 + \(\dfrac{800}{{(1 + IRR)}^1}\)

700 + 700 × IRR = 800

IRR = 100/700

IRR = 0.1428 = 14%

Therefore, the internal rate of return on the investment = 14%.

FAQs on Internal Rate of Return Formula

What is Meant by Internal Rate of Return Formula?

The internal rate of return formula calculates IRR, which is a very important component of capital budgeting and corporate finance which is used in determining which discount rate will make the initial cost of a capital investment equal to the current value of future cash flows post-tax. The term internal here signifies the fact that the calculation of rate using this method does not include external factors, such as inflation, risk-free rate, the cost of capital, or any financial risks. The formula to calculate the internal rate of return is \( 0 = \sum_{n = 1}^N \frac{ CF_n }{ (1 + IRR)^n } \)

What is the Formula to Calculate the Internal Rate of Return?

The internal rate of return formula calculates IRR, which is the value of the rate for which net present value equals zero. The formula is:

\( 0 = \sum_{n = 1}^N \frac{ CF_n }{ (1 + IRR)^n } \)

Where,

- N = Total number of time periods

- n = Time period

- CF\(_n\) = Net cash flow at time period

- IRR = Internal rate of return

What are the Rules to Calculate Internal Rate of Return?

The rules to follow while using the internal rate of return formula is:

- Set the NPV to zero and solve for the discount rate i.e. the internal rate of return

- The initial investment is always negative because it represents an outflow

- Each subsequent cash flow could be positive or negative, depending on the estimated cash flow determined by the project in the future

- IRR cannot be easily calculated analytically instead use a more technical method like excel

What is the Connection between NPV and the Internal Rate of Return Formula?

To calculate the internal rate of return formula, the net present value(NPV) formula is also used. The internal rate of return is considered as the interest rate that makes the value of NPV is zero i.e. the discounting rate of NPV is equal to zero.

visual curriculum