Interest Formula

The word interest means the extra amount earned by the investor along with the investment (or) the amount owed by the borrower along with the amount lent. There are two types of interests: simple interest and compound interest. The interest formula talks more about the types of interests. Let us learn more about the interest formula and solve a few examples.

What is Interest Formula?

The interest formula includes two types of interests - simple interest and compound interest. The fee paid to the lender for lending a loan is called the interest. This extra amount or the interest is what needs to be paid along with the actual loan. The interest formula talks about both the types of formulas - Simple Interest Formula and Compound Interest Formula. The interest formula for both are:

Simple Interest = P × R × T

Compound Interest = P(1 + r/n)nt- P

Simple Interest Formula

Simple interest is calculated with the following formula: S.I. = P × R × T,

Where,

- P = Principal, it is the amount that is initially borrowed from the bank or invested.

- R = Rate of Interest, it is at which the principal amount is given to someone for a certain time, the rate of interest can be 5%, 10%, or 13%, etc., and is to be written as r/100.

- T = Time, it is the duration for which the principal amount is given to someone.

The amount is the money a person takes a loan from a bank and needs to return the principal borrowed plus the interest amount. In other words,

Amount = Principal + Simple Interest

A = P + S.I.

A = P + PRT

A = P(1 + RT)

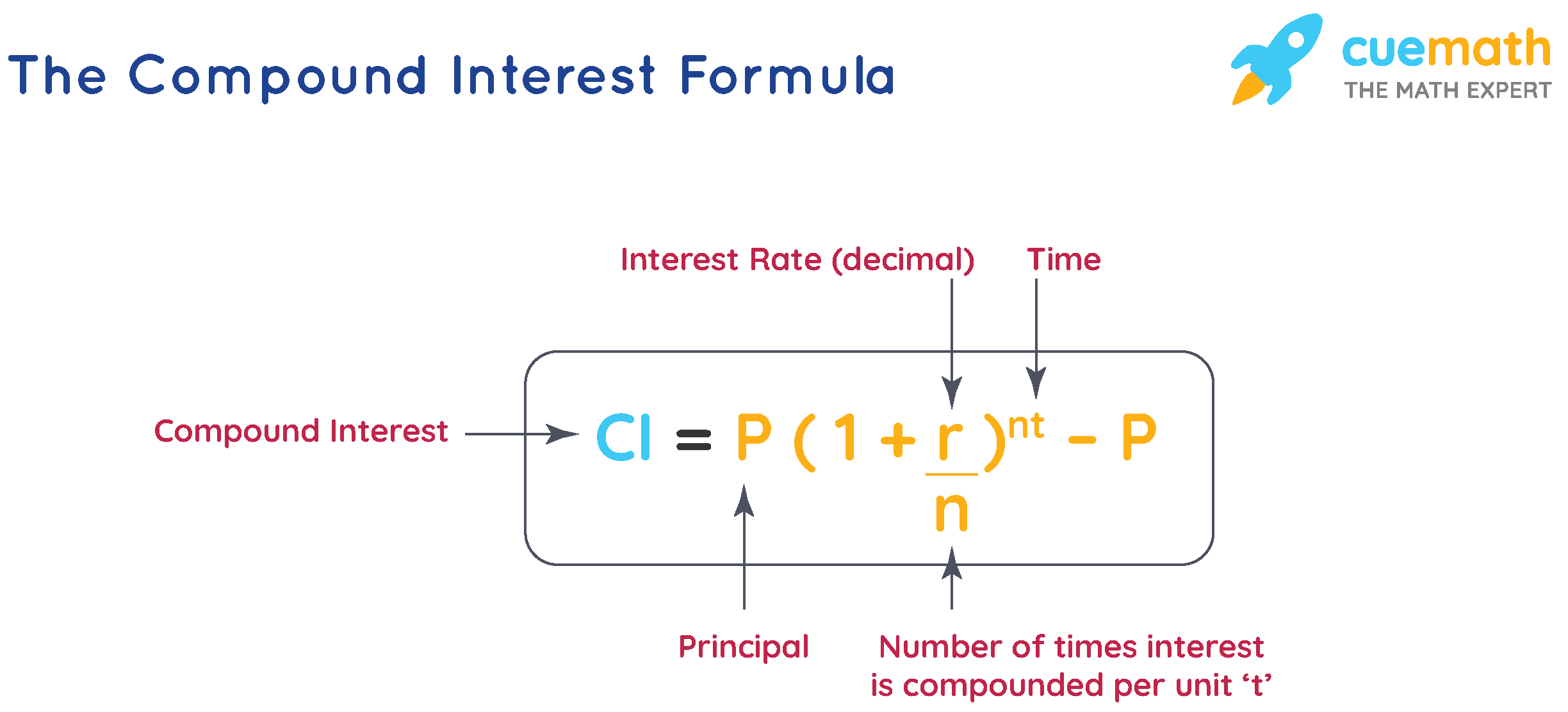

Compound Interest Formula

The compound interest is calculated, after calculating the total amount over a period of time, based on the rate of interest, and the initial principal. The formula to calculate the compound interest is:

CI = P(1 + r/n)nt- P

Where,

- P is the principal amount

- r is the rate of interest

- n is frequency or no. of times the interest is compounded annually

- t is the overall tenure

Simple Interest Vs Compound Interest

| Simple Interest | Compound Interest |

| Simple interest is calculated on the original principal amount every time | Compound interest is calculated on the accumulated sum of principal and interest |

|

Simple Interest Formula is: S.I.= P×R×T |

Compound Interest formula is: C.I.= P×(1+r)nt−P |

| It is equal for every year on a certain principal | It is different for every span of the time period as it is calculated on the amount and not principal |

Examples Using Interest Formula

Example 1: What is the simple interest on the principal amount of $10,000 in 5 years, if the interest rate is 15% per annum?

Solution:

To find the simple interest using the given information:

The principal amount, P = $10,000.

The rate of interest, r = 15% = 0.15.

Time, t = 5 years.

Using the simple interest formula,

I = P × R × T

I = 10000 × 0.15 × 5 = 7500

Therefore, the simple interest = $7,500

Example 2: You have invested $1000 in a bank where your amount gets compounded daily at 5% annual interest. Then what is the compound interest that you get after 10 years?

Solution:

To find the compound interest after 10 years:

The principal amount is P = $1000

The rate of interest is, r = 5% =5/100 = 0.05

The time in years is t = 10.

Since the amount is compounded daily, n = 365

Using the compound interest formula:

Compound Interest = P (1 + r / n)n t - P

Coumpound Interest = 1000(1 + 0.05/365)365×10- 1000

Therefore, the compound interest = $648.66

Example 3: If Maria borrowed a sum of $40500 for a period of 20 months at 10% per annum, how much simple interest will she pay?

Solution:

To find: Simple Interest

The principal amount is $40500 and the rate of interest is 10% = 10/100. The time period given is 20 months = 20/12 years.

Using the formula for interest I= P×R×T.

I= 40500 × 10/100 × 20/12

I= $6750

Therefore, Maria is going to pay $6750

FAQs on Interest Formula

What is Interest Formula?

The interest formula includes the two types of interests - simple interest and compound interest. The word interest means the extra amount with the loan amount taken. The extra amount or the interest is what needs to be paid along with the actual loan. The interest formula consists of both simple interest and compound interest.

What is the Difference Between Simple Interest and Compound Interest?

Simple interest is the interest paid only on the principal, whereas, compound interest is the interest paid on both principal and interest compounded at regular intervals.

What is the Formula for Simple Interest?

Simple interest is calculated with the following formula: S.I. = P × R × T,

Where,

- P = Principal, it is the amount that initially borrowed from the bank or invested.

- R = Rate of Interest, it is at which the principal amount is given to someone for a certain time, the rate of interest can be 5%, 10%, or 13%, etc., and is to be written as r/100.

- T = Time, it is the duration for which the principal amount is given to someone. It might be calculated monthly or annually.

What is the Formula for Compound Interest?

The compound interest is calculated, after calculating the total amount over a period of time, based on the rate of interest, and the initial principal. The formula to calculate the compound interest is:

CI = P(1 + r/n)nt- P

Where,

- P is the principal amount

- r is the rate of interest

- n is the frequency or number of times the interest is compounded annually

- t is the overall tenure

visual curriculum